Ultimate Guide to the P2P Process

The Purchase to Pay (P2P) process encompasses the entire journey from the initial requisition of goods or services to the final payment to suppliers. This end-to-end process involves multiple steps, including requisitioning, purchasing, receiving, processing invoices, and payment and storage of information for audit purposes. The Purchase to Pay process is crucial for organisation’s efficiency, increased cost control, and better transparency in their procurement and financial operations. By streamlining these interconnected steps, businesses can enhance their procurement accuracy, reduce cycle times, optimise costs, increase compliance and reduce the risk of fraud. This introduction sets the stage for a comprehensive understanding of the P2P process and its significance in modern business operations. Automating the accounts payable function can result in as much as a 60% increase in productivity and an 83% reduction in purchase order processing time.

This guide will provide an overview of the workflow, covering the pain points experienced, and how to streamline the overall process.

What is a Procure to Pay (P2P) process?

A Procure to Pay (P2P) process is a workflow of all the stages that an organsiation goes through to purchase goods or services. From the original requisition from the wider business right through to receipt of order and payment. The initial request for goods can come from anywhere in the organsiation and generally triggers a purchase order. Goods arrive, are receipted and invoice is received for payment. The order and receipt are matched to the invoice, and if correct, the invoice is processed for payment and filed for future auditing.

Obviously, these stages are unique in their execution to each organsiation; many orders won’t have a purchase order, goods are not always receipted, and matching is often 2 way or not at all.

The P2P Cycle and Workflow

The P2P cycle starts with a request and finishes with payment. The P2P steps within this cycle are unique to every organsiation in the way they are executed and delivered. The number of processes within the P2P workflow including data collected and stored, invoice coding and approvals, tolerances and compliance, archiving and post-delivery review depend on goods, industry, business size and reporting needs. The stages from the P2P workflow listed below aim to cover most organisation’s processes but are not necessary for all businesses.

Requisition

The P2P flow begins with identifying the need for goods or services. This can come from anywhere in the wider business, with team members submitting requisitions specifying what is required.

Supplier Identification and Selection

Once the need is identified, the procurement team researches potential suppliers and chooses the one that best meets its requirements. This involves considerations such as cost, quality, reliability, infosec requirements and ESG compliance.

Purchase Order (PO) Creation

After identifying a supplier and budget checking, a purchase order is generated. The PO outlines the details of the purchase, including the quantity, description of goods or services, agreed-upon price, and delivery terms. It often triggers an approval process at this stage and provides cost centre coding to assist with invoice processing post-delivery. In some cases, purchase orders are sent directly to suppliers and as such form a contract of intent to purchase.

Goods/Services Receipt

Upon delivery of the goods or completion of the services, the receiving department confirms that the supplier has fulfilled the order according to the terms specified in the purchase order.

Invoice Processing

An invoice arrives from the supplier, and the finance or accounts payable department verifies that the invoice matches the original purchase order and that the goods or services were received as specified. If there are discrepancies the invoice is either rejected and sent back to the supplier or placed on hold until a resolution is found.

Approval and Payment

Once the invoice is verified, if it has been matched with purchase order that has been coded and pre-approved it can be sent to the finance system for the next payment run. If the purchase order process does not include approval and payment, then it is sent for approval based on business rules of the business. Once approved it is passed to the finance system for payment.

Record keeping and Analysis

Throughout the entire process, proper archiving and storage is essential. This includes maintaining records of requisitions, purchase orders, invoices, and payments for auditing purposes. The data can also be used for supplier lifecycle management and contract analysis. Analysing this data can provide insights into procurement efficiency, cost control, and supplier performance.

What is an End to End P2P Process?

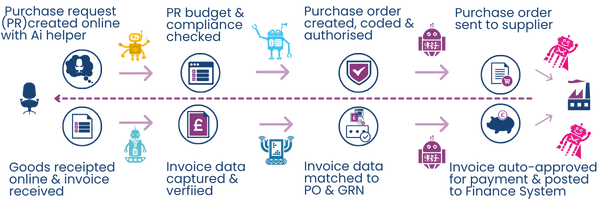

The end-to-end Procure to Pay (P2P) process involves identifying procurement needs, creating purchase requisitions, issuing purchase orders, verifying delivered goods or services, matching and approving invoices, and processing payments. Meticulous record keeping ensures transparency and compliance, providing data for analysis. The graphic below shows in simple terms the P2P workflow from the request to purchase right through to payment.

How to Improve the P2P Flow and Process

To improve the P2P flow and process, organisations can implement several strategies.

Streamlining the Requisition Process

Having an email box for all requisition requests to be sent to and a log of requests received showing the status that is accessible by the wider business gives visibility of the progress of the purchase.

Use a purchase request form that has fields to help the AP team code the purchase and check budget constraints.

Early Stage Approvals

Getting approval at the purchase request stage means no need for further approvals for an invoice if it is matched is achieved at PO level and with a GRN.

No PO, No Pay

Adopting a No PO no Pay strategy within the business streamlines the whole P2P workflow making 3 way matching, approval and coding easy and budget analysis a continuous process.

Educate the Team

Provide training for the wider business so that all team members understand the P2P workflow. This will ensure compliance and minimise the risk of delays in receiving and payment of goods, help prevent fraud and reduce the workload of the P2P team.

How an Automated P2P System Can Streamline the Process

With both the procurement and accounts payable departments concerned with improving the purchase to pay processing cycle and visibility across this cycle, as well as reducing processing costs, organisations are increasingly turning to the implementation of one solution which solves these pain points better than two. The diagram below shows in simple form the areas that automation can assist with the purchase to pay process.

Purchase Requisition Management

Automation can simplify and speed up the requisition process, allowing users to submit requests digitally. Documation’s powerful Ai assists requisitioners by suggesting favourite suppliers, checking budgets and auto coding based on department, requisitioner or supplier. This reduces manual paperwork, minimises errors, and accelerates the initiation of the procurement cycle. It also gives visibility to the requisitioner of the status of the request.

Smart Supplier Management

Automation tools can assess and manage supplier information, helping organisations make informed decisions during supplier selection. Documation’s supplier onboarding module ensures business rules around Infosec and ESG can be used for supplier selection compliance and control. Verification can also be made on company address, company number, VAT number and bank details. Evaluating supplier performance and assessing historical data for strategic sourcing is an essential part of the supplier management.

Purchase Order Automation

Automated Purchase Order (PO) creation ensures consistency, accuracy, and adherence to predefined rules. This reduces the risk of errors and ensures that all necessary information is included in each PO, facilitating smoother transactions with suppliers. An approval matrix uploaded during implementation of the Documation solution means business rules around approval levels are always adhered to. Ongoing management of the approval matrix is managed by the team with delegated authority as a fraud prevention measure.

Goods/Services Receipt Automation

Implementing automation in the goods or services receipt process ensures timely and accurate verification. It enables the seamless matching of received goods or services with corresponding purchase orders, reducing discrepancies and preventing payment delays. POs that aren’t receipted are added to Documation’s P2P workflow where automated reminders are sent to the requisitioner to alleviate the workload on the AP team.

Invoice Processing

Documation’s P2P solution uses intelligent capture for data and documents. Once the invoice data is in the solution, invoice processing workflows streamline the matching and verification of invoices against purchase orders and delivery receipts. The cost centre coding allocated at purchase order level, along with the approval is linked to the invoice allowing straight through processing with no manual intervention and minimises the risk of errors and fraud. Documation’s P2P workflow automatically processes matched invoices, integrating fully with the finance system to post the invoice ready for payment making a touchless invoice process. Any non-PO or invoice queries are managed with the exception workflow with minimum input required from the AP team. Built-in machine learning and Ai mean that actions are learned and added to the automation for future processing, to iterate automation.

Workflow Automation for Approvals

For Non-PO invoices Documation’s solution automates approval workflows based on business rules to expedite the approval process by routing documents to the appropriate stakeholders. This ensures that invoices and purchase requests move through the system efficiently, avoiding bottlenecks and delays.

Payment Automation

Automated payment systems facilitate timely and accurate payments to suppliers. Documation’s solution uses their Web Services Connector to link to 3rd party software to enable payment automation. This includes electronic payment methods, reducing the need for manual check processing and improving cash flow management.

Data Analytics for Decision-Making

Automation enables organisations to collect and analyse data throughout the P2P process. Documation’s P2P automation solution uses MS Power BI to provide reports for KPIs, government mandated reporting and dashboards for analysis by the wider business. This data-driven approach provides insights into spending patterns, supplier performance, and process efficiency, empowering better decision-making.

Compliance Management

Documation’s P2P automation solution allows predefined business rules to enforce compliance with internal policies and external regulations. It can flag irregularities, ensure proper documentation, and reduce the risk of non-compliance.

Continuous Monitoring and Improvement

Automated systems provide real-time visibility into the P2P process, allowing organisations to monitor performance metrics and identify areas for improvement. This supports ongoing optimisation efforts and ensures that the process evolves with changing business needs.

Storage and Archiving

Documation’s solution stores invoices and their full data trail, showing each touch point, by which user and when, for full audit and control. All corresponding documentation is also stored alongside the invoice. This can be retrieved from either the finance system directly or from the Documation solution. Data is kept securely and follows the government mandates for storage. Documation pride themselves their info security and as such are certified as ISO 27001.

Documation’s P2P Expertise

At Documation, we help with more than finance. We listen to your P2P worries and learn about your business, which helps us make a plan that fits your requirements perfectly.

Get in touch with our listening team to see how we can help!