What is Purchase to Pay Automation?

Purchase to Pay or P2P automation allows for simple, efficient online creation of purchase requests by any approved user with built in supplier policies, budget checking and contract enforcement. Approval is completed online and orders are issued electronically to suppliers. Receipt of goods and services is recorded and invoices, received and processed without paper, are matched and issued for payment.

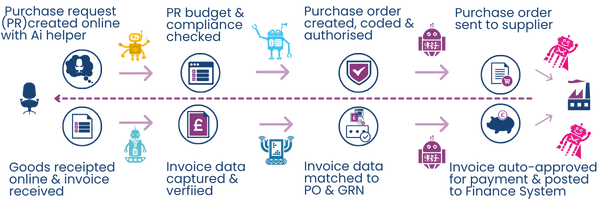

The Purchase to Pay Cycle

Purchase to Pay is a business process that includes all the processes involved in buying goods and services.

Below is a diagram documenting the touch points for the process of an item request, order, approval, and delivery through to payment.

- Purchase requests

- Purchase orders

- Goods receipting

- Invoice processing

- Payments

Touchless Processing

A digital P2P solution simplifies the purchase request and authorisation process, while ensuring that corporate buying policy is enforced.

eForm purchase requests incorporating automatic field population and online validation is fast and efficient. Approved suppliers can be enforced, spend authorisation and delegation of authority controls are built in, budget and contract checking is automatic and general ledger coding is accurately applied.

Based on business rules a request is routed to the relevant authoriser or buyer. An authoriser receives online notification of a request, eliminating a major bottleneck that can arise in purchase processing, which can be approved, forwarded or rejected online.

Approved requests trigger the automatic creation of a purchase order (PO), customised to company standards and sent via email.

When goods are received they are recorded online with discrepancies noted and suppliers notified immediately.

Automation tools are provided to help the AP team deal efficiently with exceptions but for the majority of invoices processing becomes fully automated; electronic invoices are captured, relevant data extracted, invoice matching completed and posted to the finance system ready for payment with no manual intervention.

Here is the same cycle with automation, showing software robots automating manual processes.

Choosing a P2P Automation Provider

With a procure to pay automation solution, organisations can streamline and control purchases, ordering and receipting, while automated invoice matching eliminates many of the issues preventing efficient processing in the AP department. Time is saved when users follow the procure to pay process because requests are easy to raise, approve and monitor.

Control purchases

Rogue spending of goods and services is avoided, approved suppliers are used and purchasing decisions controlled before orders are committed

Apply rules

P2P automation ensures approval rules are enforced and risk areas monitored to ensure compliance

Verify and 2 or 3 way matching

Invoices are easy to verify and match through the entire process. Credit notes can be requested as soon as an issue is found, offering procurement departments complete visibility and control.

Save money

Identify cost savings and discount opportunities by faster payment times, reduce supplier lists; analyse and improve the buying process, with visibility across the process. Identify bottle necks and processing issues with real time reporting

Integrate

Integrate with Finance systems to remove manual data entry and errors, automatically check for duplicates at source.

Remove Paper

All invoices and associated documents securely stored and archived for viewing at anytime, with full audit trail. No need for filing or paper copies.

P2P creates fast, efficient, straight-through – paperless – processing

How Documation can help

As well as providing useful finance guides to help wider problems, we delve deep into your pain points to understand your business’ needs and what may be causing them. We take time to listen, ask questions and get to know you so that we’re able to offer a bespoke solution to suit your requirements.

Get in touch with our listening team to see how we can help!