The Chancellors Spring Statement last week announced new proposals for tackling the late payment culture that is affecting many SMEs. Research from the Federation of Small Businesses shows that approximately 50,000 small business close a year due to poor payment practise.

The initial directive will require listed companies to report and publish payment practises as part of their annual reports. Phillip Hammond, Chancellor of the Exchequer, went as far as to suggest that large companies should appoint a non-executive director to be responsible for reducing late payments to smaller suppliers.

Late payments within large companies are often caused by bottlenecks around data capture, matching and approvals.

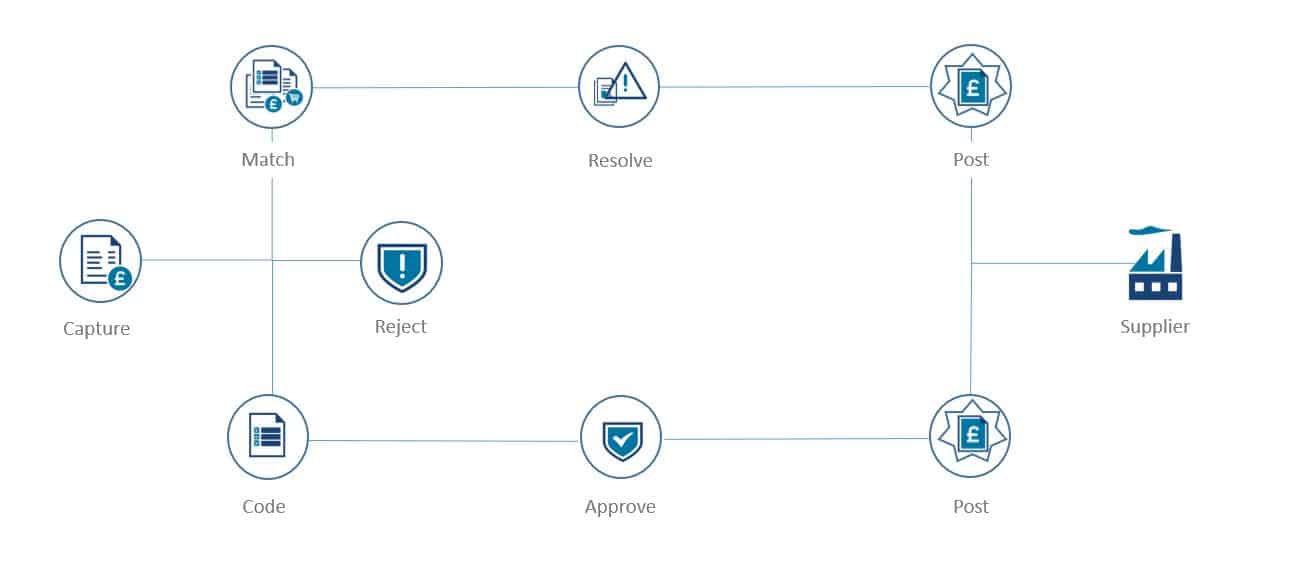

AP Automation deals with these pain points by automating the workflow, aiming for a touchless straight through process, but the reality is that not all invoices will fit this profile. The life story of an invoice can be shown in the diagram below.

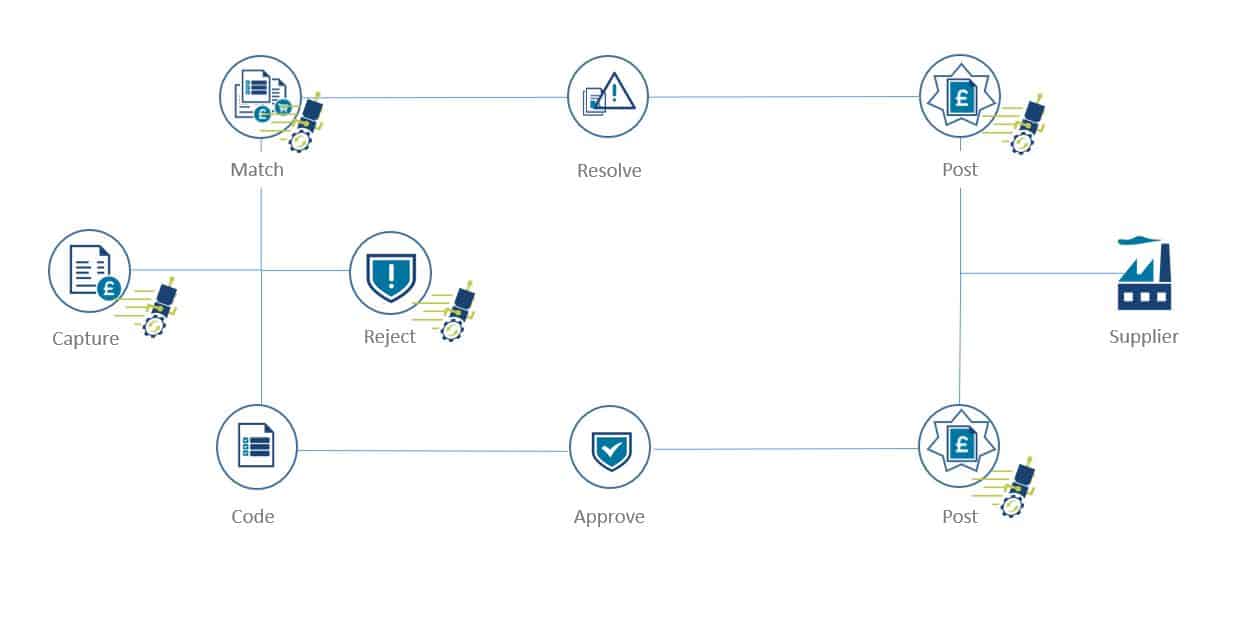

Adding automation to the journey of an invoice, as shown by the robots in the diagram below, has huge benefits, not just with processing times, by freeing up bottlenecks that cause a delay in payments, but also with visibility. As well as being able to pinpoint exactly which areas are causing issues such as invoice by department, supplier, approver means, AP automation provides the metrics for the Duty to Report on Payment Practises and Performance mandated by the Department for Business, Energy and Industrial Strategy from April 2017.

Companies who exceed 2 of the 3 criteria below must report on their supplier payment performance every 6 months for financial years beginning on or after 6 April 2017.

- £36m annual turnover

- £18m gross assets

- 250 employees

Reporting is split into three categories

- the average time taken to pay invoices from the date of receipt of invoice

- what percentage of invoices paid within the reporting period were paid in less than 30 days, between 31 and 60 days, and over 60 days

- the percentage of invoices due within the reporting period which were not paid within agreed terms

Listed companies that have yet to automate their AP processes are going to feel the pinch at year end with another aspect of reporting to include in their annual statements. AP Automation, be it a full process automation project or phased implementation, requires time, effort and buy in from all stakeholders. The AP team are usually the first to adopt and advocate the changes but projects are sometimes delayed or stalled by Director buy-in. Perhaps this governmental push for C-suite involvement in the payment process will encourage early adoption from the more hesitant stakeholders! If you would like more information on AP automation please get in touch.