Ultimate Guide to the P2P Process

The Purchase to Pay (P2P) process encompasses the entire journey from the initial requisition of goods or services to the final payment to suppliers. This end-to-end process involves multiple steps, including requisitioning, purchasing, receiving, processing invoices, and payment and storage of information for audit purposes. The Purchase to Pay process is crucial for organisation’s efficiency, increased cost control, and better transparency in their procurement and financial operations. By streamlining these interconnected steps, businesses can enhance their procurement accuracy, reduce cycle times, optimise costs, increase compliance and reduce the risk of fraud. This introduction sets the stage for a comprehensive understanding of the P2P process and its significance in modern business operations. Automating the accounts payable function can result in as much as a 60% increase in productivity and an 83% reduction in purchase order processing time.

This guide will provide an overview of the workflow, covering the pain points experienced, and how to streamline the overall process.

What is a Procure to Pay (P2P) process?

A Procure to Pay (P2P) process is a workflow of all the stages that an organsiation goes through to purchase goods or services. From the original requisition from the wider business right through to receipt of order and payment. The initial request for goods can come from anywhere in the organsiation and generally triggers a purchase order. Goods arrive, are receipted and invoice is received for payment. The order and receipt are matched to the invoice, and if correct, the invoice is processed for payment and filed for future auditing.

Obviously, these stages are unique in their execution to each organsiation; many orders won’t have a purchase order, goods are not always receipted, and matching is often 2 way or not at all.

The P2P Cycle and Workflow

The P2P cycle starts with a request and finishes with payment. The P2P steps within this cycle are unique to every organsiation in the way they are executed and delivered. The number of processes within the P2P workflow including data collected and stored, invoice coding and approvals, tolerances and compliance, archiving and post-delivery review depend on goods, industry, business size and reporting needs. The stages from the P2P workflow listed below aim to cover most organisation’s processes but are not necessary for all businesses.

Requisition

The Procure-to-Pay process begins with identifying a business need for goods or services. Requests can be raised by users across the organisation, with requisitions capturing what is required before moving through approval and purchasing stages.

Supplier Identification and Selection

Once the need is identified, the procurement team evaluates potential suppliers and selects the option that best meets business requirements. This assessment typically considers cost, quality, reliability, information security standards, and ESG compliance.

Purchase Order (PO) Creation

Once a supplier is selected and budget checks are complete, a purchase order (PO) is raised. The PO defines the purchase details, including quantities, goods or services, agreed pricing, delivery terms, and cost centre coding to support invoice processing after delivery.

At this stage, approval workflows are typically triggered. In many cases, the PO is issued directly to the supplier, forming a contractual intent to purchase.

Goods/Services Receipt

Once goods are delivered or services completed, the receiving department confirms that the order has been fulfilled in line with the terms of the purchase order.

Invoice Processing

An invoice arrives from the supplier, and the finance or accounts payable department verifies that the invoice matches the original purchase order and that the goods or services were received as specified. If there are discrepancies the invoice is either rejected and sent back to the supplier or placed on hold until a resolution is found.

Approval and Payment

Once an invoice is verified, it is matched to the purchase order. If the PO is already coded and pre-approved, the invoice is sent directly to the finance system for the next payment run. Where approval has not been completed at the PO stage, the invoice is routed for approval based on defined business rules before being passed to the finance system for payment.

Record Keeping and Analysis

Proper archiving and storage are essential throughout the entire Procure-to-Pay process. This includes securely retaining requisitions, purchase orders, invoices, and payment records for audit purposes.

The data can also be used to support supplier lifecycle management and contract analysis, with insight into procurement efficiency, cost control, and supplier performance.

What is an End to End P2P Process?

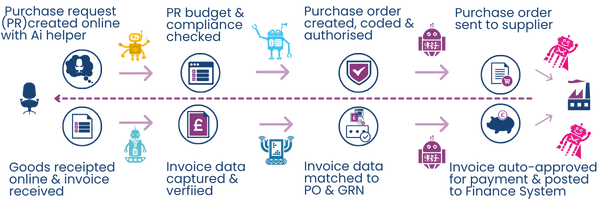

The end-to-end Procure to Pay (P2P) process involves identifying procurement needs, creating purchase requisitions, issuing purchase orders, verifying delivered goods or services, matching and approving invoices, and processing payments. Meticulous record keeping ensures transparency and compliance, providing data for analysis. The graphic below shows in simple terms the P2P workflow from the request to purchase right through to payment.

How to Improve the P2P Flow and Process

To improve the P2P flow and process, organisations can implement several strategies.

Streamlining the Requisition Process

Using a central email inbox for requisition requests, supported by a shared log showing request status, gives the wider business clear visibility of purchase progress.

A structured purchase request form with predefined fields also helps the AP team apply correct coding and check budget constraints before the request moves forward.

Early Stage Approvals

Securing approval at the purchase request stage removes the need for further invoice approvals when the invoice is successfully matched to an approved purchase order and goods received note (GRN).

No PO, No Pay

Adopting a “No PO, No Pay” policy streamlines the entire Procure-to-Pay workflow, making three-way matching, approvals, and coding more efficient while supporting continuous budget analysis.

Educate the Team

Provide training across the business so all team members understand the Procure-to-Pay workflow. This improves compliance, reduces the risk of delays in receiving and paying for goods, helps prevent fraud, and lowers the workload on the P2P team.

How an Automated P2P System Can Streamline the Process

With both the procurement and accounts payable departments concerned with improving the purchase to pay processing cycle and visibility across this cycle, as well as reducing processing costs, organisations are increasingly turning to the implementation of one solution which solves these pain points better than two. The diagram below shows in simple form the areas that automation can assist with the purchase to pay process.

Purchase Requisition Management

Automation simplifies and speeds up the requisition process by allowing users to submit requests digitally. Documation’s AI supports requisitioners by suggesting preferred suppliers, checking budgets, and applying automatic coding based on department, requester, or supplier.

This reduces manual paperwork, minimises errors, and accelerates the start of the procurement cycle, while giving requisitioners clear visibility into the status of their requests.

Smart Supplier Management

Automation tools can assess and manage supplier information, helping organisations make informed decisions during supplier selection. Documation’s supplier onboarding module ensures business rules around Infosec and ESG can be used for supplier selection compliance and control. Verification can also be made on company address, company number, VAT number and bank details. Evaluating supplier performance and assessing historical data for strategic sourcing is an essential part of the supplier management.

Purchase Order Automation

Automated purchase order creation ensures consistency, accuracy, and compliance with predefined business rules, reducing errors and ensuring all required information is captured for smoother supplier transactions.

An approval matrix configured during implementation enforces approval levels automatically, with ongoing management by authorised users to maintain control and support fraud prevention.

Goods/Services Receipt Automation

Automating the goods and services receipt process ensures timely, accurate verification and seamless matching with purchase orders, reducing discrepancies and avoiding payment delays.

Purchase orders that are not receipted are routed into Documation’s P2P workflow, where automated reminders are sent to requisitioners, reducing follow-ups and easing the workload on the AP team.

Invoice Processing

Documation’s P2P solution uses intelligent capture for data and documents. Once the invoice data is in the solution, invoice processing workflows streamline the matching and verification of invoices against purchase orders and delivery receipts. The cost centre coding allocated at purchase order level, along with the approval is linked to the invoice allowing straight through processing with no manual intervention and minimises the risk of errors and fraud.

Documation’s P2P workflow automatically processes matched invoices, integrating fully with the finance system to post the invoice ready for payment making a touchless invoice process. Any non-PO or invoice queries are managed with the exception workflow with minimum input required from the AP team. Built-in machine learning and Ai mean that actions are learned and added to the automation for future processing, to iterate automation.

Workflow Automation for Approvals

For non-PO invoices, Documation’s solution automates approval workflows based on defined business rules, routing documents to the appropriate stakeholders. This ensures invoices and purchase requests move through the system efficiently, reducing bottlenecks and approval delays.

Payment Automation

Automated payment systems facilitate timely and accurate payments to suppliers. Documation’s solution uses their Web Services Connector to link to 3rd party software to enable payment automation. This includes electronic payment methods, reducing the need for manual check processing and improving cash flow management.

Data Analytics for Decision-Making

Automation enables organisations to collect and analyse data throughout the P2P process. Documation’s P2P automation solution uses MS Power BI to provide reports for KPIs, government mandated reporting and dashboards for analysis by the wider business. This data-driven approach provides insights into spending patterns, supplier performance, and process efficiency, empowering better decision-making.

Compliance Management

Documation’s P2P automation solution enforces predefined business rules to ensure compliance with internal policies and external regulations. It flags irregularities, ensures proper documentation, and reduces the risk of non-compliance.

Continuous Monitoring and Improvement

Automated systems provide real-time visibility into the Procure-to-Pay process, enabling organisations to track performance metrics and identify opportunities for improvement. This supports continuous optimisation and ensures the process adapts to changing business needs.

Storage and Archiving

Documation’s solution stores invoices and their full data trail, showing each touch point, by which user and when, for full audit and control. All corresponding documentation is also stored alongside the invoice. This can be retrieved from either the finance system directly or from the Documation solution. Data is kept securely and follows the government mandates for storage. Documation pride themselves their info security and as such are certified as ISO 27001.

Documation’s P2P Expertise

At Documation, we help with more than finance. We listen to your P2P worries and learn about your business, which helps us make a plan that fits your requirements perfectly.

Get in touch with our listening team to see how we can help!