In today’s rapidly evolving business landscape, organisations face numerous challenges, and a persistent threat is fraud. As technology advances, so do the tactics of fraudsters. One area particularly vulnerable to fraudulent activities is the accounts payable (AP) process. However, businesses can strengthen their defense’s by embracing accounts payable automation

The Landscape of Fraud:

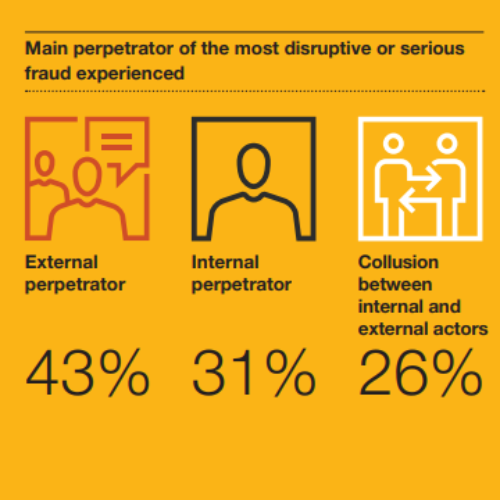

Fraud encompasses a wide range of activities, from internal employee fraud to sophisticated external attacks. Common fraudulent schemes include invoice fraud, email phishing, CEO fraud, payment card/credit card fraud and employee fraud. 51% of surveyed organisations by PwC say they experienced fraud in the past two years, the highest level in our 20 years of research. These incidents can result in financial losses, damage to reputation, and legal consequences. As businesses increasingly rely on digital transactions and data, the need for robust anti-fraud measures becomes paramount.

The Role of Accounts Payable in Fraud Prevention:

Fraud encompasses a wide range of activities, from internal employee fraud to sophisticated external attacks. Common fraudulent schemes include invoice fraud, email phishing, CEO fraud, payment card/credit card fraud and employee fraud. 51% of surveyed organisations by PwC say they experienced fraud in the past two years, the highest level in our 20 years of research. These incidents can result in financial losses, damage to reputation, and legal consequences. As businesses increasingly rely on digital transactions and data, the need for robust anti-fraud measures becomes paramount.

Key Benefits of Accounts Payable Automation in Fraud Prevention

Invoice Validation and Verification:

Automated systems can validate invoices against predefined criteria, ensuring accuracy and authenticity. This reduces the risk of processing fraudulent invoices and mitigates the possibility of overpayment.

Authorisation Workflows:

Implementing automated approval workflows ensures that all payments undergo proper authorisation. This eliminates the risk of unauthorised transactions and ensures that multiple eyes review high-value transactions.

Real-time Monitoring:

Automation enables real-time monitoring of financial transactions, allowing businesses to detect irregularities promptly. Any deviation from established patterns or suspicious activities can trigger immediate alerts for further investigation.

Secure Vendor Master Data:

Automated systems help maintain a secure and accurate vendor database. This prevents fraudulent activities such as creating fictitious vendors or modifying existing vendor details to divert payments.

Encrypted Communication:

Automation facilitates secure and encrypted communication channels between various stakeholders, preventing interception and manipulation of sensitive financial information.

Audit Trails and Compliance:

Automated AP solutions generate detailed audit trails, documenting every step of the payment process. This not only aids in fraud detection but also ensures compliance with regulatory requirements.

Integration with AI and Machine Learning:

By leveraging artificial intelligence and machine learning algorithms, accounts payable automation can continuously learn from historical data, identifying patterns indicative of fraud. This adaptive approach enhances the system’s ability to detect emerging threats.

Conclusion:

As the threat landscape continues to evolve, businesses must adopt proactive measures to safeguard their financial processes. Accounts payable automation emerges as a robust solution, not only streamlining operations but also fortifying defences against fraud. By combining technological advancements with a commitment to best practices, organisations can create a resilient framework that protects against the ever-present risk of business fraud. As we navigate the digital age, the integration of accounts payable automation stands as a strategic investment in the long-term security and sustainability of businesses worldwide.