Digital Transformation by Another Name

Following an insightful webinar from Chris Argent from GENCFO, there seems to be a new buzzword on the scene eRecovery! But what’s it all about?

To summarise, its digital transformation – post pandemic. There is no definition found in a google search, but Economic Recovery is a good start …..

Investopedia’s definition is as follows:

“The business cycle stage following a recession that is characterized by a sustained period of improving business activity. Normally, during an economic recovery, gross domestic product (GDP) grows, incomes rise, and unemployment falls as the economy rebounds.”

Chris Argent defined eRecovery as:

“The term for the use of digital tools to improve a company’s chances of success, particularly in the context of significant global disruption.”

The pandemic was the most significant global disruption the world has experienced for decades and it forced a change in business processes, and for some businesses, an earlier than planned move towards digital transformation.

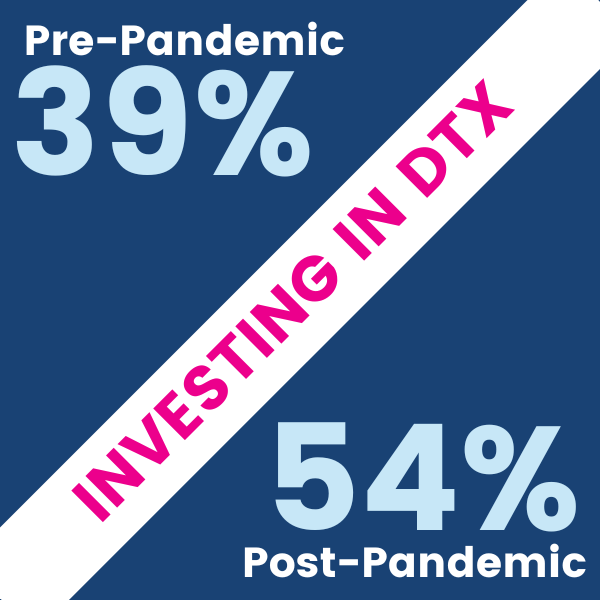

Pre pandemic on 39% of companies surveyed were investing in digital transformation, postpandemic/now that figure has risen to 54%.

It’s important to remember that despite the trigger being the pandemic, and the transformation being in the form of automation, it’s the leaders in the business that enabled the change. The CFO’s had to transform their budget decisions, reallocate spend to areas of the business that previously had not been a priority and make decisions for the survival of the business.

CFOs are experts in the field of finance and often have a good set of data/tech skills but are not IT experts and have had to learn, change and adapt in the forced journey to automation, and bring their team along with them. Understanding the tech involved in the planned digital transformation and ensuring that it is future proofed was (and still is) a challenge.

The pandemic may have pushed many businesses to accelerate their digital transformation, but it also highlighted the importance of futureproofing the changes. Siloed attempts of digitisation have no place in the post pandemic world. Businesses need to make sure they are prepared for the next large scale disruption and can adapt to the changes in working practices this brings. Planning end to end digital transformation involves forensic analysis of processes to ensure that what ever change is implemented only automates the ‘good’ processes and is scalable in line with business growth.

eRecovery is obviously about growth but also about sustainability and scalability. In the survey Chris refers to in his talk, the top reason for digital transformation was to create efficiencies, closely followed by increasing profitability. Bottom of the list was cost cutting. Also on the list for digital transformation is improving compliance with regulation. This is high priority for many companies with cyber security and privacy being key. The increased use of cloud technology, the remote working culture, sharing of resources, and integration of solutions across businesses puts it at a high level of importance. Making sure that compliance is part of the plan is part of the end to end transformation is key to futureproofing the business and enabling scalable, agile working practices.

A few years ago scaremongering around robots taking over, and humans being replaced by robots was rife. But the past couple of years has shown this has not played out to be true. The survey that was used in the webinar shows that an average of only 15% of the workforce will experience any effect of automation in the next 5 years and this is more in the way of change of workload rather than work replacement. The focus is not on cost cutting by the way of headcount but more about saving money through improved processes.

To sum up, eRecovery is happening ……every day. And is even more important now, with the squeeze in the economy, increase in interest rates and cost of living, and the comprised supply chains due to Brexit and the war in Ukraine. Companies need to support their CFOs to work with solution providers to accelerate their end to end digital transformation to support growth, battle the challenges and continue to lead their teams and business for ongoing success. For more information on how we can support your eRecovery get in touch with the [email protected]