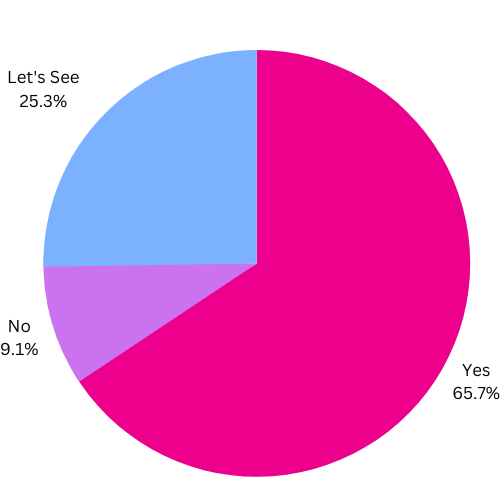

There has been a wealth of articles, comments, posts, podcasts and vlogs on the ‘New Kid on the AI block’ – ChatGPT. But what is it, how does it work and what will it mean for finance teams? GenCFO ran a LinkedIn poll on whether ChatGPT has a place in accounting and finance a few weeks ago and got the following results :

It seems the majority of people voting are positive in its adoption, with a quarter still sitting on the fence.

But what exactly is ChatGPT and how does it work?

Well, if you ask ChatGPT what it is, you get this

“ChatGPT is an Ai language model developed by OpenAI, which is capable of generating human-like text based on the input it is given. The model is trained on a large corpus of text data and can generate responses to questions, summarize long texts, write stories and much more. It is often used in conversational AI applications to simulate a human-like conversation with users.”

In more general terms it uses a large language model (LLM) which has been trained on hundreds of terabytes of text, most of it having been sourced (or ‘read’) from the web to respond to questions by mimicking human language and conversation.

The first thing to remember about ChatGPT is that it only gives responses on data it has been trained on, or ‘learned.’ The information that it has runs up to 2021 so there is a limit on its current knowledge. However, to counter that, it uses Ai to learn from the questions it’s asked. For instance, if you ask a question and think that the response is incorrect, you let the chatbot know and it will add your updated information to its knowledge base.

The other point to note is that where search engines such as Google give the sources of the information it is displaying, therefore allowing the user to check and verify the answers for themselves and decide on the accuracy, ChatGPT does not.

However, even with these 2 caveats, there is a lot of excitement around the role Ai will have in Finance Teams.

An imagined future with Ai in Finance

A CFO gets asked for productivity figures. A future thinking CFO could have access to voice activated app that integrates with Power Bi and he can request – via his phone – the sales predictions for last year and this year and the forecast deviation year to date. He will be able to immediately share these figures with the wider business and they can adapt their sales strategy accordingly in a fraction of the time

The finance team are putting into place some new procedures around expense claims. A future thinking Finance leader can ask the chatbot for ‘A procedure for expense claims for a Retail business with a turnover of £2million and 45 staff.’ A document will be produced, ready for basic editing and implementation.

Financial controllers are struggling to get people to submit their budgets on time and are not sure how to communicate the impact this has. Ask the Chatbot how to have ‘Meaningful conversations on what it means to me to hit a deadline.’

These examples just scratch the surface of functionality of Ai chatbots in finance teams. By removing the time taken up with learning and researching puts finance teams in a position to deliver higher value to the rest of the business. If you ask ChatGPT how it can change the way back office operations are run for large multinational organisations? It answers:

“ChatGPT can change the way back office operations are run for large multinational organizations by automating routine tasks, improving accuracy, and reducing human errors through the use of natural language processing and machine learning algorithms. For example, ChatGPT can be used to perform data entry, answer customer queries, and provide analysis and insights. By integrating ChatGPT into back-office operations, organizations can streamline processes, increase efficiency, and improve the overall customer experience. Additionally, the technology can be customized to meet specific organizational needs and scale to accommodate growth.“

The takeaway from this response is that ChatGPT saves human’s time doing manual tasks, improves accuracy, researching and/or learning, and provides immediate answers to questions for both customers and the wider business.

- Automating routine tasks

- Perform data entry

- Answer customer queries

- Provide analysis and insights

ChatGPT can, for example, ‘automate routine tasks’ but it will not be a replacement for other software solutions that are already available for automating processes for the Finance Team. For example;

“ChatGPT, as a language model developed by OpenAI, is not designed to replace invoice automation. Instead, it is designed to assist and provide information to users. Invoice automation is a technology solution that automates the process of generating, sending, and tracking invoices to improve efficiency and accuracy. ChatGPT can provide information about invoice automation and other related topics, but it is not a replacement for the actual software.

It’s important to note that ChatGPT and invoice automation serve different purposes and have different functions. While ChatGPT can provide information and assistance, invoice automation provides a comprehensive solution for automating the invoice process.”

Does this mean the robots are taking over (again ….?)

The simple answer is ‘No’

Learn to use this technology as a tool, understand it’s limits and use it where appropriate.

Years ago, spreadsheets were revolutionary. There were people that devoted their time to automating key strokes, transferring, calculating and extrapolating with macros to save time and effort for the Finance team.

Chat GPT is just the Macro of the future.

We couldn’t work without spreadsheets …………now is the time to adopt a new technology.

Get in touch to find out how we can help stramline your processes.