What is the perception of Accounts Payable in an organisation? A cost centre or a profit centre? And is it only about perception or are there some hard facts that back up the ‘Accounts Payable as a Profit Centre’ claim?

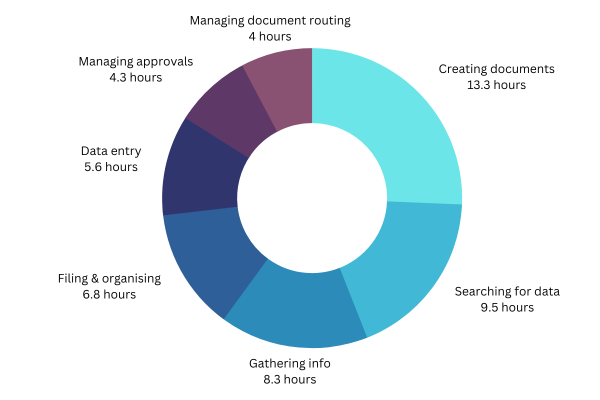

The IDC researched working patterns for knowledge workers (team members responsible for handling and/or using data) in the AP Team. 51.8 hours per week are spent on data management

Reviewing Your AP Strategy

Reviewing a business’s Accounts Payable Strategy could help transform the perception and add ongoing cost savings to the bottom line. If the current processes include unnecessary overheads (printing, paper, storage, and team resource), missed discounts, late payments, and duplicate payments then it’s a good time for reconsideration.

The best place to start is at the beginning of the AP process – the Invoice. Ninety percent of organisations receive invoices in some sort of electronic format; either EDI, e-invoice or pdf, but many are still printing, and storing these invoices in paper form.

Going paperless rids the business of all the associated costs of paper but will require a secure and compliant storage solution.

Capturing the data from invoices and associated documents at the point they arrive in the business removes the data entry requirement from the team saving on average 5.6 hours a week.

Duplicate invoices are eliminated by capturing the data digitally. Studies by the Accounts Payable Association have shown that two thirds of UK finance professionals have received duplicate invoices, other studies suggest duplicate payments make up approximately 1% of all invoices paid.

By having the invoices stored digitally removes labour intensive tasks such as printing, manual filing and retrieval, and storage costs for secure office space, but adds to the problem of effective data handling. Businesses are still producing 4 billion pages of paper documents per year, and the data being stored is more than doubling year on year.

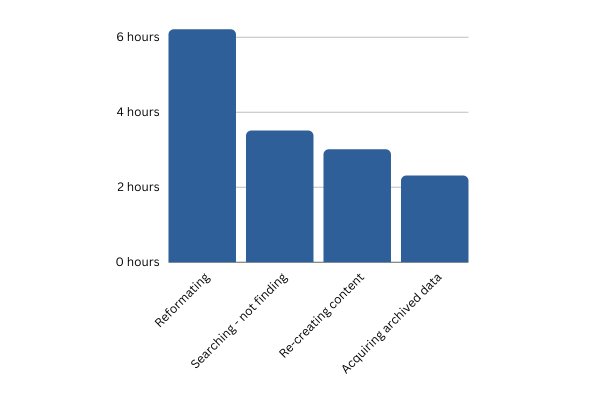

The IDC survey shows that knowledge workers waste hours approx. 15 per week on data handling.

How Automation Can Help

Implementing automation to capture and handle the invoice data is the first step to streamlining the accounts payable process. But exploring further into the process with a view to automation reveals further areas where costs can be saved.

Looking back at the figures around data management, a significant amount of time (16.6 hours) is spent gathering information for matching to PO/GRN, sending for approvals and managing document routing. By automating the matching and approval processes invoices can move through these stages seamlessly and give the AP team full visibility at every stage ensuring they are matched correctly and if not routed automatically back to the supplier. Invoices are not lost within the business or held up in an approval matrix.

Processing invoices quickly ensures no late penalties are incurred. The organsiation can also take advantage of dynamic discounting, a system where discounts can be negotiated for early settlement of invoices. This results in bigger profit margins for goods/services which can be attributed to accounts payable. Both measurable cost savings.

The enhanced visibility can be used in reporting for process improvement to further enhance profitability. Using spend analysis for cost comparisons across the master vendor database and identifying non compliance through automatically generated real time reports.

The final stage of the invoice journey is payment and understanding the cost implications of how invoices are paid, ensuring the most cost effective and efficient system is used and that it benefits the business in terms of cash flow. Many payment providers will integrate with a finance system to further automate payments and some offer negotiation on terms as part of the service, and others come with additional charges. A review of the costs/benefits in terms of cash flow is a good start with payment options.

Making automation central to the Accounts Payable as a ‘Profit Centre’ strategy enables team members to remove tasks such as data capture, matching, approval chasing , posting, filing and manually producing reports from their day to day work. Invoices can be processed within hours of arriving in an inbox to give easy access to early payment discounts and improved visibility of cashflow. The team can begin to spend time analysing the data that is now readily available, using it for process improvements. Changing the perception of the Accounts Payable as a cost centre may be the biggest part of the challenge. But with careful benchmarking, and measurements against KPIs it is possible to start to influence the change. Add to that the advocacy of the AP team in adopting and promoting the ‘AP as a Profit Centre’ strategy, all goes towards the recognition that the Accounts Payable department deserves within the organisation.